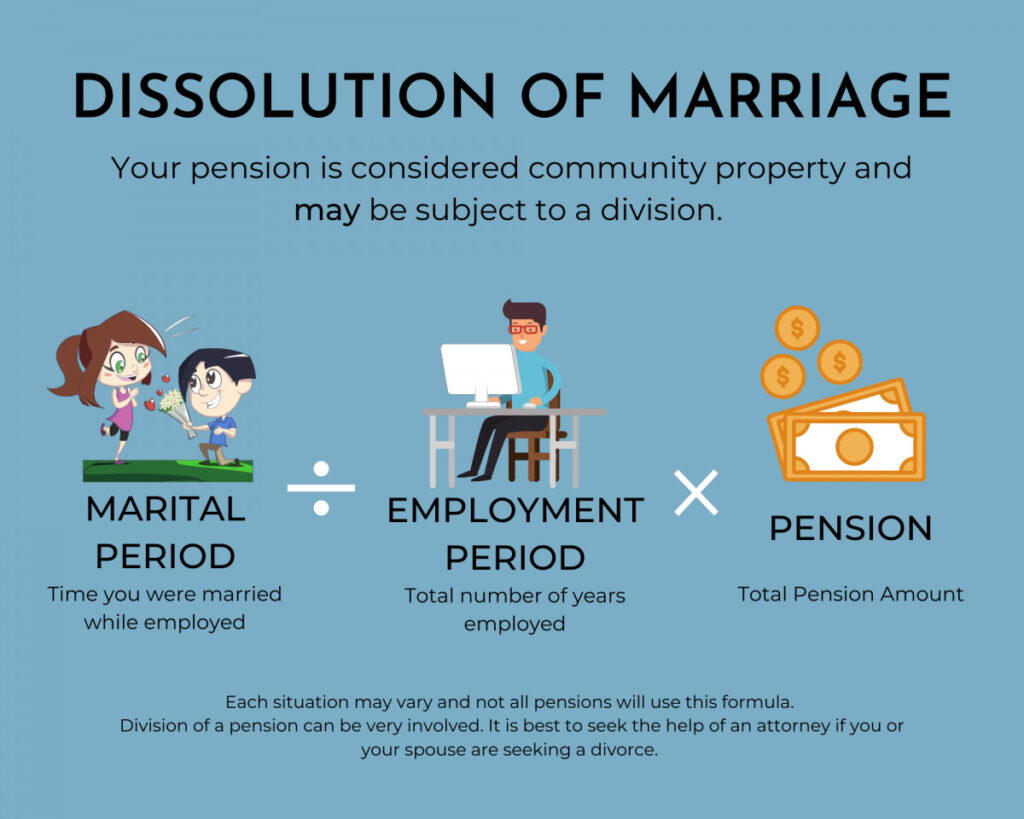

DISSOLUTION OF MARRIAGE AND YOUR PENSION

Pension benefits and contributions are considered assets and may be subject to community property laws. The graphic below is designed to give you an overview of how a dissolution of marriage may affect your pension. Keep in mind – not all dissolutions are created equal. All dissolution decrees must be reviewed by the City Attorney prior to any release of pension funds:

SCENARIO: A member had a career spanning 26 years and earned a total pension of $6,500. The member was married for 8 of the 26 years, but dissolved the marriage.

To calculate the member’s final pension, we must first calculate the ex-spouse’s portion, then subtract that amount from the original pension:

Step 1: 8 years of marriage / 26 years of service = 0.31 (Community Property %)

Step 2: $6,500 x .31 = $2,015 (Community Property Portion of Total Pension)

Step 3: $2,015 / 2 (Member and ex-spouse each receive 1/2 of Community Property Portion) = $1,007.50 each

Step 4: $6,500 (Original) – $1,007.50 (paid to ex-spouse) = $5,492.50 (Member’s Pension)

Reminders:

- This is an example of how community property is calculated for a 50:50 division. However, your pension will be divided as indicated in your dissolution decree documents, which may be higher or lower than 50% or your ex-spouse may waive his/her community property rights to your pension benefits completely.

- A dissolution of marriage that occurred PRIOR to your membership with LAFPP will not affect your pension.

- All future dissolution judgments will be reviewed by the City Attorney and processed by LAFPP according to the stipulations in the dissolution decree.

We strongly advise that you consult with your own legal advisor in the event of a dissolution of marriage.

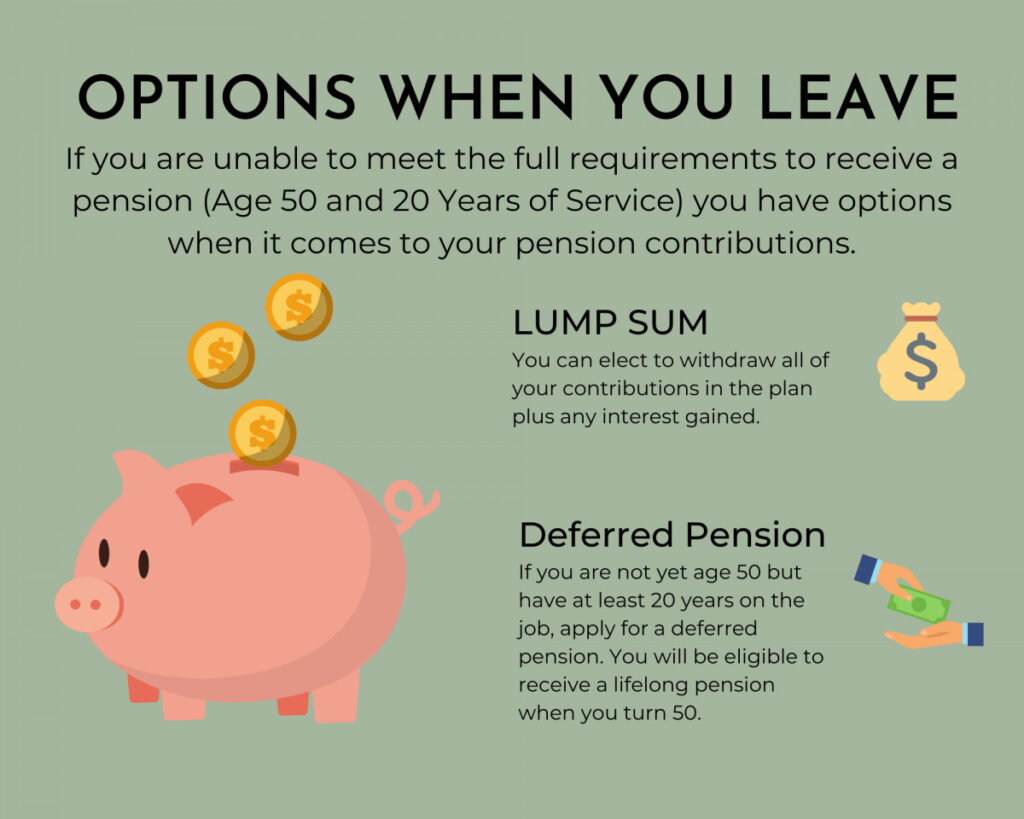

OPTIONS WHEN LEAVING

Choosing to leave before retirement eligibility does not mean a total loss of your contributions. A Tier 6 member who has not yet met both requirements to retire (Age 50 and 20 Years of Service) may have options available to them depending on the situation:

SCENARIO: A TIER 6 MEMBER IS OFFERED A CHANCE TO BE A CHIEF IN A NEIGHBORING CITY. SHE IS NOW 45 YEARS OLD WITH 22 YEARS OF SERVICE. WHAT ARE HER OPTIONS?

OPTION 1: REFUND OF CONTRIBUTIONS

Upon termination/resignation, Tier 6 members may withdraw all contributions made (PLUS interest gained) while they were employed with their department.

This member can opt to receive a lump-sum payment, which she can then rollover to an individual retirement account (IRA) or other qualified plan, or receive as a cash payment. Tax implications are a big factor in choosing what to do with the money. Please consult with a tax advisor.

OPTION 2: DEFERRED PENSION OPTION

The Deferred Pension Option (not to be confused with DROP), offers Tier 6 members who have at least 20 years of service, but are not yet age 50, the option to terminate active service and defer their pension until they reach age 50.

In our scenario, the member would leave her contributions in the Plan and receive a deferred pension at the age of 50.