WHILE RETIREMENT MAY SEEM LIKE A DISTANT NOTION, RETIREMENT PLANNING IS A JOURNEY BEST TAKEN EARLY.

At this early stage of your career, we understand that retirement planning may not seem like a high priority. Here at LAFPP, we provide a multitude of resources to help you get a clearer picture of what’s ahead and to assist you in planning for your retirement.

In this walk-through, we will cover the basics of the LAFPP Pension (“the Plan”). There are graphics, videos and outside links to help you on your journey…

LET’S GET STARTED!

Scroll through or click on the links below to jump to a topic:

Pensions and Contributions

Upon graduation from the Academy/Drill Tower, you became a TIER 6 member of the Los Angeles Fire & Police Pension (LAFPP) plan. LAFPP is a Defined Benefit (DB) Plan, so once you meet the requirements for retirement you will receive a LIFELONG PENSION based on a specific formula.

After you graduated you began contributing 11% of your salary to LAFPP each pay period. You are required to contribute this percentage of your salary, which goes toward your pension and the funding of health benefits. If you terminate employment prior to retirement, your contributions and accrued interest are refundable.

These contributions are automatically deducted from your paycheck and may not be altered unless mandated by the City Charter.

Check out this summary video and scroll below to read more:

Service Pensions – When You Can Retire

In order to qualify for a service pension, a Tier 6 member must be:

At least Age 50 and have at least 20 Years of Service (YOS)

Both requirements must be met. This means that if you entered at a young age, you will have to work longer until you reach age 50.

How A Pension Is Calculated

Regardless of your total contributions you paid throughout your career, your pension will be calculated based on a formula of:

Final Average Salary x Pension Percentage

Final Average Salary

Average base pay, plus any pensionable bonuses* for any 24 consecutive month period (within your career) that you designate. Generally, the last 24 months of service is where you expect to be at your highest rank and with the highest salary. Overtime pay does not count.

*Please see your Memorandum of Understanding (MOU) for a complete list.

Pension Percentage

A percentage is allotted for each year of service you work, after you reach 20 years of service. The percentage is pro-rated to last completed pay period.

40% at 20 years of service

additional 3% per year for Years 21-25

additional 4% per year for Years 26-30

additional 5% per year for years 31-33

90% maximum benefit

See table below.

Years of Service Pension Percentage Table

| IF YOUR YEARS OF SERVICE EQUALS… | THEN YOUR YEARS OF SERVICE PENSION PERCENTAGE IS… |

|---|---|

| 20 | 40% |

| 21 | 43% |

| 22 | 46% |

| 23 | 49% |

| 24 | 52% |

| 25 | 55% |

| 26 | 59% |

| 27 | 63% |

| 28 | 67% |

| 29 | 71% |

| 30 | 75% |

| 31 | 80% |

| 32 | 85% |

| 33 or more | 90% |

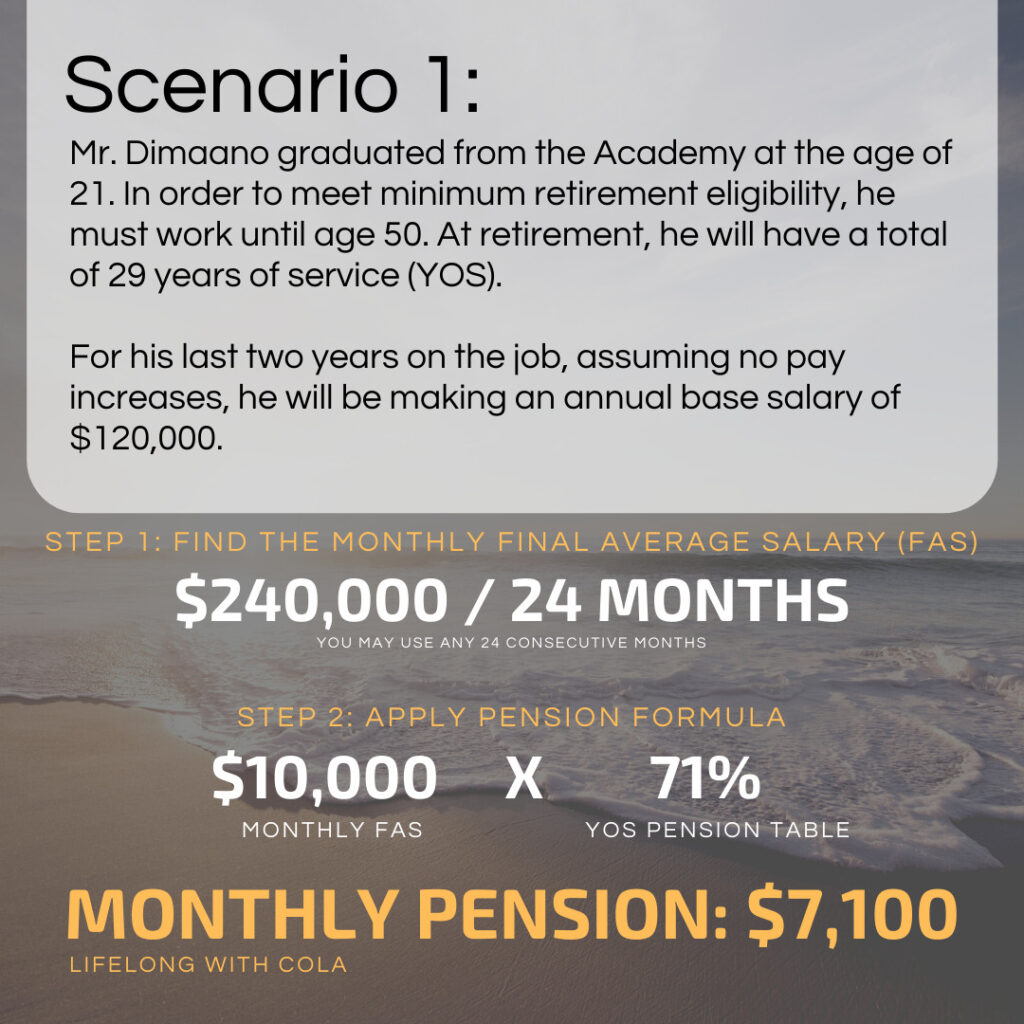

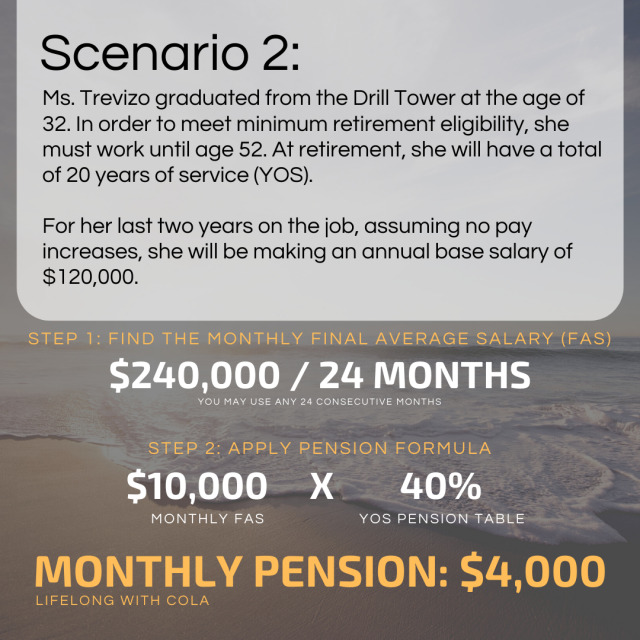

The following are sample scenarios with the most basic assumptions. Both individuals plan to retire at the earliest retirement eligibility of Age 50 and 20 Years of Service. Your results may vary based on multiple factors including, but not limited to, total salary compensation and years of service.

The pension calculation above is a gross amount and will be taxed according to Federal and California State income tax laws. In both cases, the member has the option to work longer in order to realize either:

- Higher pension percentage

- Receive pay increases

- Or a combination of both

The longer you work, the higher potential for a larger pension.

Important Documents

In the event you become permanently disabled while working, you have the option to apply for a Disability Pension.