Tax Form 1099-R

As you prepare to file your taxes, below are a couple of options for obtaining your 1099-R Tax Form:

Available online beginning January 31 on MyLAFPP

You may view and/or print a copy of your 1099-R tax form by logging into your MyLAFPP portal. See below for instructions on how to access MyLAFPP.

Mailed to all members on January 31 via USPS

If you prefer to wait for a hard copy of your 1099-R tax form, it will be mailed to your address on file via U.S. mail on January 31st. Please allow up to 10 business days to receive your 1099-R by mail. If you have not received your 1099-R form by February 15, please contact the Accounting Section at (213) 279-3040, (844) 88-LAFPP ext. 3040, or via email at [email protected] to request a copy.

Frequently Asked Questions

Help with MyLAFPP

First time logging in:

If this is your first time accessing your MyLAFPP member portal, you will be required to register for a MyLAFPP account. To do so, a temporary one-time Personal Information Number (PIN) is required. To request a PIN, please follow the “Register to MyLAFPP” guide for step-by-step instructions.

I forgot my username/I need help with my username:

For security purposes, staff does not have access to your username. Your username can be retrieved and sent to your email by verifying your information and answering your security question. Visit our “How Do I Recover My Username” page for step-by-step instructions.

I forgot my password/I need help with my password:

For security purposes, staff does not have access to your password. A temporary password can be sent to your email by verifying your information and answering your security question. Visit our “How Do I Reset My Password” page for step-by-step instructions.

How to download your 1099-R:

Please Note: If you prefer to wait for a hard copy of your 1099-R tax form, it will be mailed to your address on file via U.S. mail on January 31. Please allow up to 10 business days to receive your 1099-R by mail.

Important: In order to access your information, you must first register to the MyLAFPP member portal. Please refer to the MyLAFPP Helpdesk on how to register and other helpful self-service “How-to’s.”

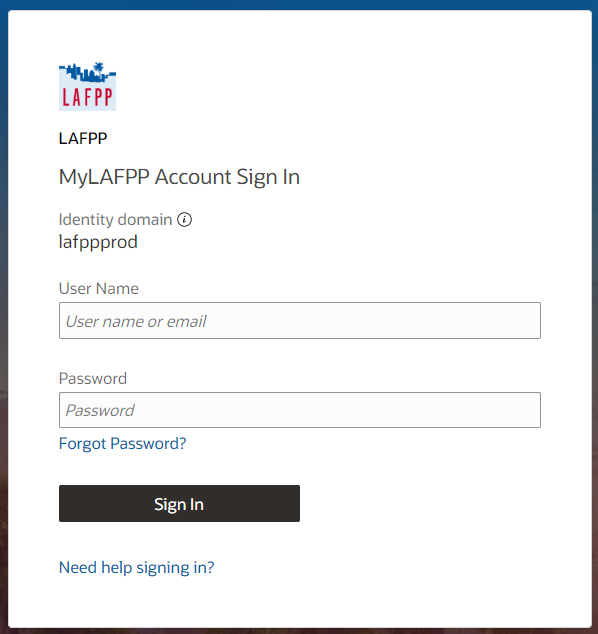

STEP 1: Log in to MyLAFPP. Enter your username and password, then click Log In.

Important: Passwords are case sensitive.

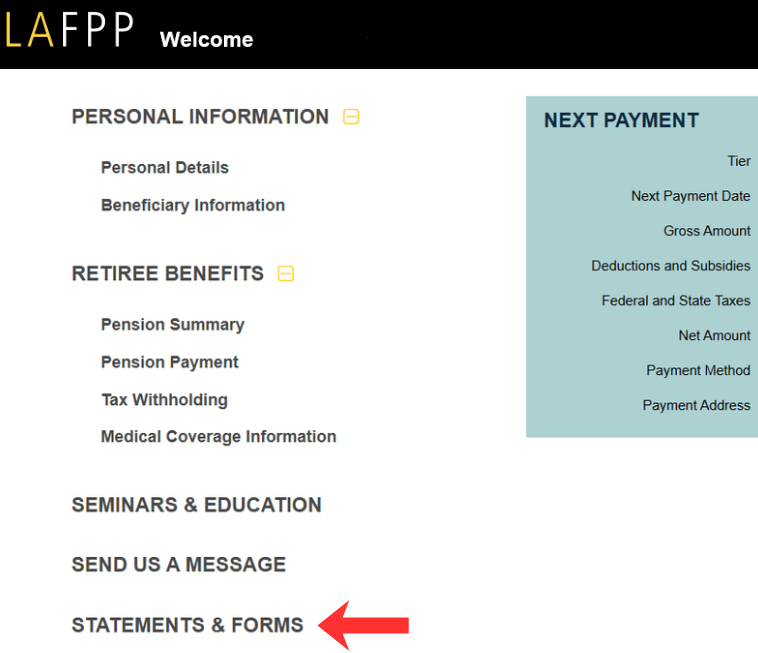

STEP 2: Click on “Statements & Forms”

STEP 3: Click “Statements”

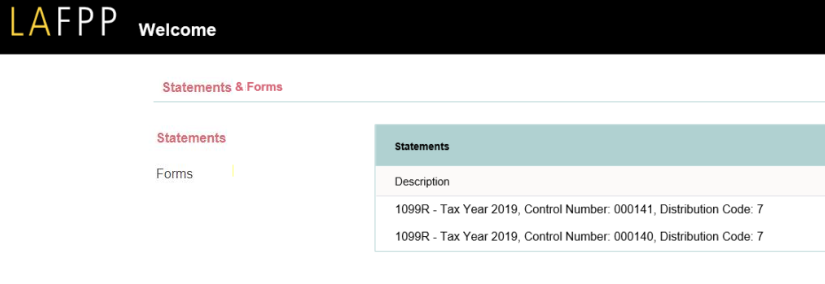

STEP 4: Click “Document” to Open or Download Your Form 1099R

Contact Us

If you require further assistance, please contact the Retirement Services Section at (213) 279-3125 or (844) 88-LAFPP ext. 3125, Monday-Friday from 7:30 a.m. to 4:30 p.m. (PDT), excluding weekends and City Holidays.

Information about Form 1099-R

Why did I receive more than one 1099 Form?

Some members may receive more than one 1099-R tax form in a year. Here are some of the possible reasons:

- You exited DROP and received the proceeds of your DROP account via a rollover, a lump-sum cash distribution, and received at least one monthly pension check in the same year. In this case you would receive a total of three Forms 1099-R: One Form 1099-R for the DROP rollover (Distribution Code G), one Form 1099-R for the DROP lump-sum (Distribution Code 2), and one Form 1099-R for monthly pension payments (also Distribution Code 2).

- You have a non-tax dependent covered on your LAFPP-subsidized health insurance plan (e.g., domestic partner or child of a domestic partner). This 1099-R would have a Distribution Code 9.

- Your IRS tax distribution code changed during the year (i.e., the member turns age 59 ½ in the tax year). You would receive two Forms 1099-R, one for when you were under 59 ½ years old (Distribution Code 2) and another for the payments received after age 59 ½ years old (Distribution Code 7).

- You received pension payments based on your City service and from a qualified domestic relations order (QDRO) (Distribution Code 2) or as a beneficiary (Distribution Code 4).

Reminder: if you were an active employee at any time during 2025, you will also receive a W-2 tax form from the City of Los Angeles.

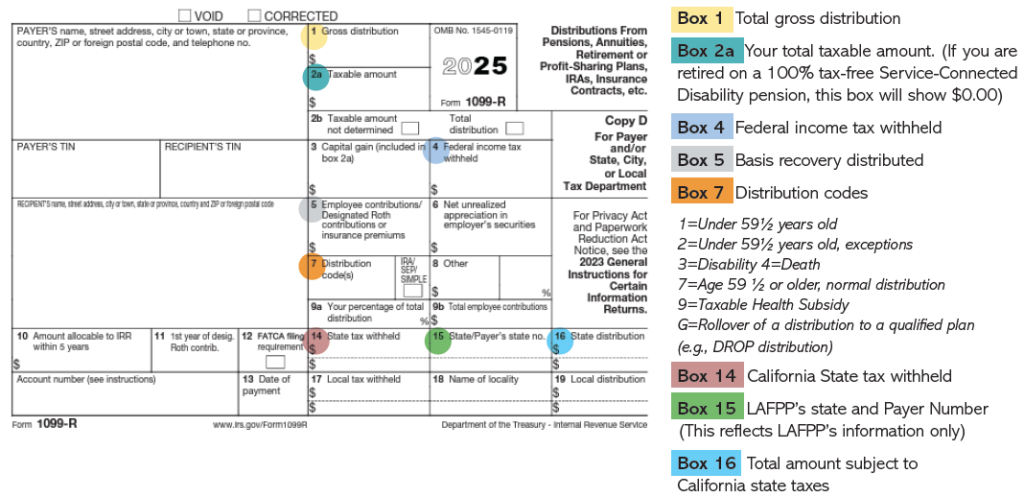

What does each box represent in the 1099-R?

Why does my 1099-R Taxable Amount (Box 2a) not equal the total amount on my pension statement?

You should be comparing the total in your December pension statement to box 1 of your 1099-R. Box 1 reflects the income received in tax year 2024. Box 2a is the taxable portion of your income received. Some or all of your income may not have been taxable, which is why box 1 and box 2a may be different. Box 2a may not be equal to the total amount in your pension statement, because you may have:

- Received more than one 1099-R form (to cover various benefits)

- Made post-tax contributions as an Active employee and therefore a portion of your pension is non-taxable (“basis recovery”)

- Had a Workers’ Compensation deduction (which reduces your taxable amount)

- A non-taxable pension

Other Information

How do I change my address?

Your form was mailed to the address on file with LAFPP. Updates to your address can be made through MyLAFPP. View our step-by-step guide on “How to Update Mailing Address” online.

If you are unable to update electronically, please download and fill out the Change of Address Form located on our website under Retired Member Forms. Please contact the Retirement Services Section at (213) 279-3125 or email [email protected] for assistance.

How do I make changes to my tax withholding elections?

Make them electronically through the MyLAFPP portal! You can make changes in 6 easy steps:

- Access MyLAFPP

- Click Retiree Benefits

- Click Tax Withholding

- Click Update Pension Tax Withholding Instructions

- Fill in all the information, even if you are only changing either Federal or State of California withholdings.

- Click Submit

Click here to view screenshots of step-by-step instructions above.

If you prefer to fill out a form. Please download and complete the Federal or State of California Tax withholdings forms found on this link. Fax or email as instructed on the form to [email protected].

If you live outside of the state of California, current system limitations do not allow you to update your tax withholding elections using the MyLAFPP portal. For assistance, please contact the Retirement Services Section at (213) 279-3125 or (844) 88-LAFPP, ext. 3125.

Important Note: In addition to Federal taxes, LAFPP will withhold state taxes for the State of California. If you reside outside the state of California, no state taxes will be withheld, and you will be responsible for any required state tax withholdings. The State tax withheld (Box 14) and State distribution (Box 16) on your Form 1099-R will be populated with $0.00.

Tax year 2024 Forms 1099-R: The State/Payer’s State No. (Box 15) will continue to reflect the LAFPP Tax ID CA/800-7968-4 regardless of your state of residence. Box 15 is an administrative 1099-R field for California payers.

How do I request a duplicate or previous year’s 1099-R?

You may download old 1099-Rs on your MyLAFPP account starting from year 2019 onward. In addition, your form was mailed to the address on file with LAFPP. Please allow time for mailing before requesting a duplicate. Requests for duplicate forms will be processed and mailed after February 15.

If you would like a replacement copy of your form, please call the Accounting Section at (213) 279-3040 or (844) 88-LAFPP ext. 3040 or send an email to [email protected].

Contact Us

If you have questions not immediately addressed above, please do not hesitate to contact us. We are available Monday-Friday from 7:30 a.m. to 4:30 p.m. (PDT), excluding weekends and City Holidays.

Retirement Services Section

Please contact the Retirement Services Section at (213) 279-3125 or email [email protected] If you have questions regarding:

- Taxability of your LAFPP pension

- State and Federal Withholding Elections and Changes

- Address Changes

- 1099-R – General Information

Accounting Section

Please contact the Accounting Section at (213) 279-3040 or email [email protected], if you have questions regarding:

- Request for duplicate copies of current year’s 1099-R (Requests will be processed after February 15)

- Request for duplicate copies of previous year’s 1099-R

Medical and Dental Benefits Section

Please contact the Medical & Dental Benefits Section at (213) 279-3115 or email [email protected], if you have questions regarding:

- Taxability of Health Subsidies

Communications & Education Section

Please contact the Communications & Education Section at (213) 279-3155 or email [email protected], if you have questions regarding:

- MyLAFPP access issues

- MyLAFPP registration